Why It’s Time to Sell Your Mineral Rights in Utah

Why It’s Time to Sell Your Mineral Rights in Utah

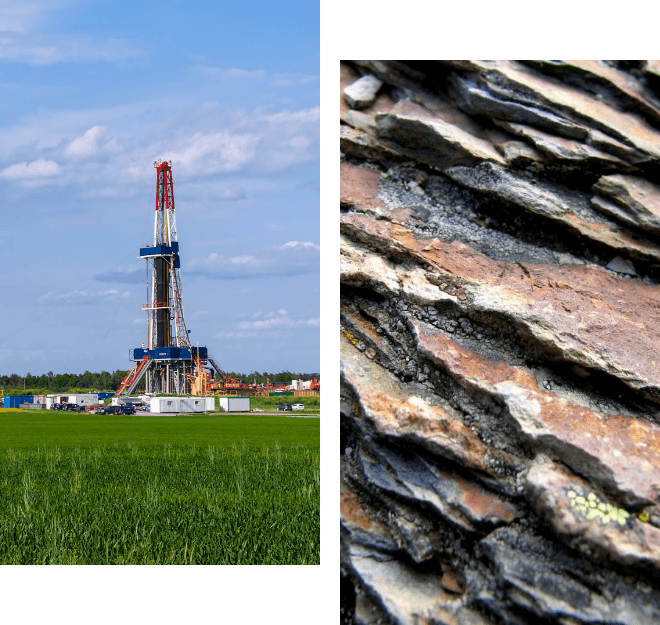

The decision to sell mineral rights is never easy, especially in a dynamic and resource-rich area like Utah. With its abundant reserves and strategic significance, the Uinta Basin has long been a focal point for energy production. However, several factors suggest that now might be the optimal time to sell your mineral rights and capitalize on current market conditions.

1. Surge in Activity in the Uinta Basin

The Uinta Basin has seen a significant uptick in exploration and production activities. Advancements in drilling technologies and extraction methods have made it more economically feasible to tap into previously inaccessible reserves. This surge in activity has increased demand for mineral rights, driving up their value.

2. High Commodity Prices

Oil and gas prices have been relatively high and stable, creating a favorable market for sellers. The geopolitical climate and market dynamics have kept prices at levels that make it an attractive time to sell. High commodity prices mean that your mineral rights are more valuable to potential buyers looking to maximize their return on investment.

3. Favorable Legislative Environment

Recent legislative changes in Utah have created a more favorable environment for oil and gas operations. These changes include streamlined permitting processes and incentives for companies investing in the state’s energy sector. A favorable regulatory environment can enhance the appeal of your mineral rights to prospective buyers, potentially leading to better offers.

4. Capitalizing on Peak Demand

The energy sector is cyclical, with periods of peak demand followed by downturns. Selling during a peak period ensures you capitalize on the high demand and avoid potential future downturns. By selling now, you lock in the current high value of your mineral rights rather than risking a potential decrease in value if the market conditions change.

5. Diversifying Your Investment Portfolio

Holding mineral rights ties your financial prospects to the volatile energy market. By selling your mineral rights, you can diversify your investment portfolio, reducing risk and potentially increasing your financial security. Diversification allows you to invest in a broader range of assets, balancing risk across different sectors.

6. Maximizing Financial Gains for Immediate Needs

Selling your mineral rights can provide a significant influx of cash that can be used to address immediate financial needs or opportunities. Whether it’s investing in a new business venture, paying off debt, or funding retirement plans, the proceeds from selling your mineral rights can be strategically used to meet your financial goals.

7. Potential for Better Offers Due to Increased Competition

The heightened interest in the Uinta Basin has led to increased competition among buyers. More companies are looking to acquire mineral rights in the area, which can drive up offers. This competitive environment can work in your favor, ensuring you receive the best possible price for your mineral rights.

Conclusion

While the decision to sell mineral rights is personal and complex, the current market conditions in Utah’s Uinta Basin present a compelling case for selling. The surge in activity, high commodity prices, favorable legislative environment, and increased competition create an opportune moment to maximize your returns. By selling now, you can capitalize on peak market conditions, diversify your investment portfolio, and achieve your financial goals.

4o

13 thoughts on “Why It’s Time to Sell Your Mineral Rights in Utah”