Guide to Selling Your Oil and Gas Mineral Rights with 1280 Royalties

Selling your oil and gas mineral rights might seem daunting, but fear not—we’re here to simplify the process and offer our expertise every step of the way.

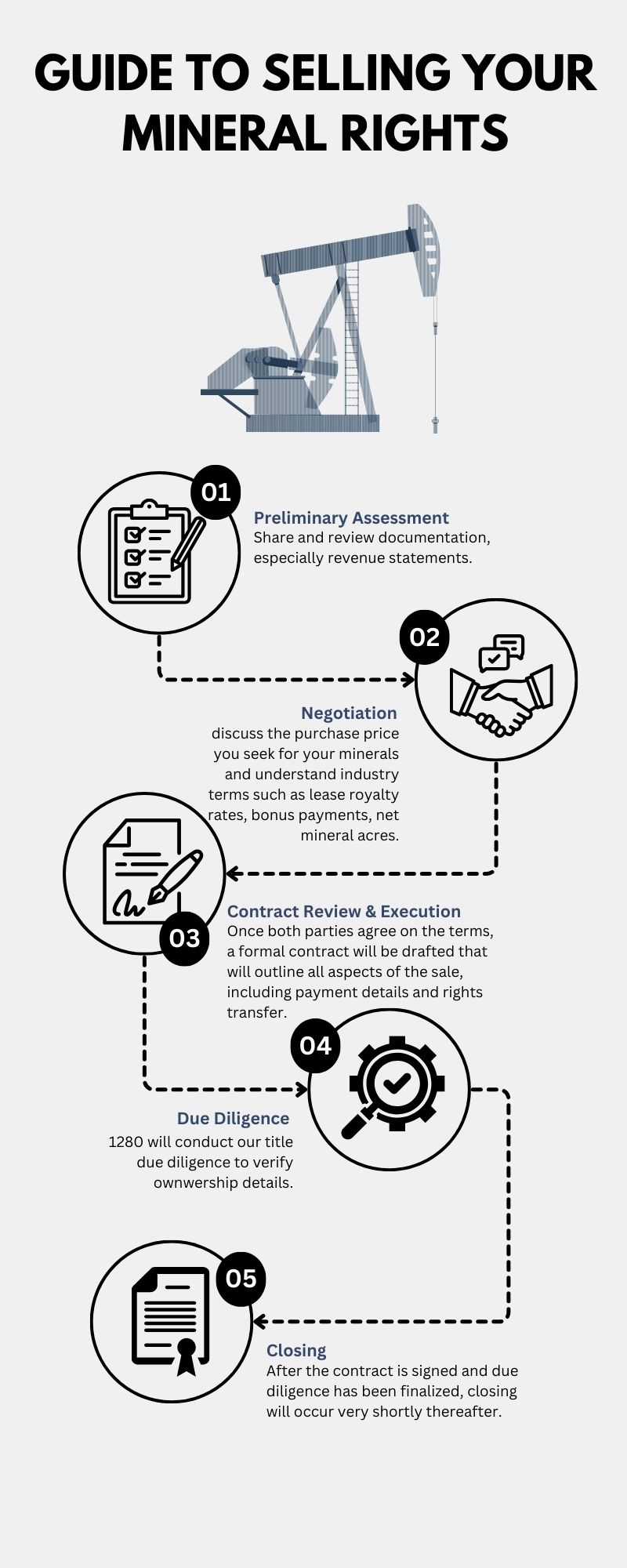

Step 1: Preliminary Assessment To kick off the process, gather all relevant documentation, including deeds, leases, existing agreements, and current revenue checks. These documents will provide essential information for assessing the value of your mineral rights.

Step 2: Negotiation Process Prepare yourself for negotiations by determining the purchase price you’re seeking for your minerals. Familiarize yourself with industry terms such as lease royalty rates, bonus payments, net mineral acres, and gross acres to ensure you’re equipped for discussions.

Step 3: Contract Drafting and Review Once both parties have agreed on the terms, a formal contract will be drafted. This comprehensive document will outline all aspects of the sale, including payment details and rights transfer. Following agreement execution, a thorough title review and due diligence process will commence.

Step 4: Due Diligence As part of our commitment to transparency and accuracy, our team at 1280 will conduct due diligence to verify the information provided. This may involve reviewing production records, assessing geological potential, and examining existing contracts and chain of title to ensure a smooth transaction.

Step 5: Closing After the contract is signed and due diligence has been completed to satisfaction, closing will take place promptly. This final step ensures the seamless transfer of mineral rights ownership.

Remember, if you have any questions or concerns throughout the process, our team is here to assist you every step of the way. We understand that mineral ownership can be complex, and we’re dedicated to making the selling process as smooth and transparent as possible for you.

13 thoughts on “Guide to Selling Your Oil and Gas Mineral Rights with 1280 Royalties”